Do you know how valuable your customers are to your business?

When it comes to business, and picking up a calculator it can be one of the most mundane and difficult tasks. I was never taught the importance of maths for business purposes, so when I have to calculate important figures, it is always a pain of a task.

The most important calculation you will do for your business, is working out your customer’s lifetime value. This is the value a customer will contribute to your business over the entire lifetime of your company.

This calculation is usually done on a per customer basis, but is determined for the average customer in your target market. If you have more than one target market, you may find that there is a different in customer lifetime worth.

Why is Customer Lifetime Value Important?

It is no news to you that it costs more to acquire a new customer, than it does to retain an existing one. Understanding your CLV (customer lifetime value) is crucial for increasing profitability, retention and overall sales success. Here are three reasons why your CLV should be a vital part of your business model, and customer retention strategy.

1. True Focus and Understanding On Your ROI

Knowing your CLV helps you focus on the communication channels that give you the most profitable customer. The way you market your business and the channels you use should be determined by the lifetime value a customer contributes to your business, rather than the gross profit on an initial purchase.

2. Give Life To Your Customer Retention Strategy

Your customer retention strategy should reflect not the value of instant revenue a customer drives, but the impact they had on the average CLV of your target audience.

3. Effective Communication & Nurturing

Knowing your CLV allows you to improve the relevance of your marketing with more effective content, and the ability to nurture your customers the way they want to be nurtured. Spend more of your time focused on the customers with a higher CLV, remember; 20% of your customers generate 80% of your revenue (Pareto’s Principle).

How to Calculate Your Customer Lifetime Value

There are two different ways you can calculate your CLV; Historic CLV, and Predictive CLV.

Historic CLV

Historic CLV is a good indication of your customer lifetime value and is simply the sum of the gross profit from all historic purchases from a specific customer. This is how the calculation works;

CLV (Historic) = Transaction 1 + Transaction 2 + Transaction 3 + Transaction N X AGM.

Transaction N = the last transaction a customer made.

AGM = Average Gross Margin.

You can calculate your CLV using your net profit, but this is a highly complex calculation and will have to be updated constantly. Using your gross margin is just as effective, and will give you great insight into how much each customer is worth to date.

Predictive CLV

This is a much more in depth and complex calculation of your CLV and will take into account previous transaction history and behavioural indicators. As long as you are calculating correctly, this will be very accurate.

Predictive CLV calculates the total value a customer will eventually give to your store over their entire lifetime.

According to Valdimir Dimitroff;

“CLV is always the NPV (net present value) of the sum of all future revenues from a customer, minus all costs associated with that customer.”

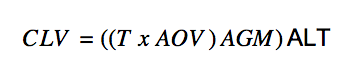

Here is the simple way to calculate Predictive CLV:

Where:

T = Average monthly transactions

AOV = Average order value

ALT = Average Customer Lifespan (in months)

AGM = Average gross margin

Let’s call the above equation gross margin contribution per customer lifespan (GML).

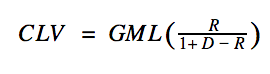

Here is the detailed way to calculate Predictive CLV;

Where:

R = monthly retention rate

D = monthly discount rate.

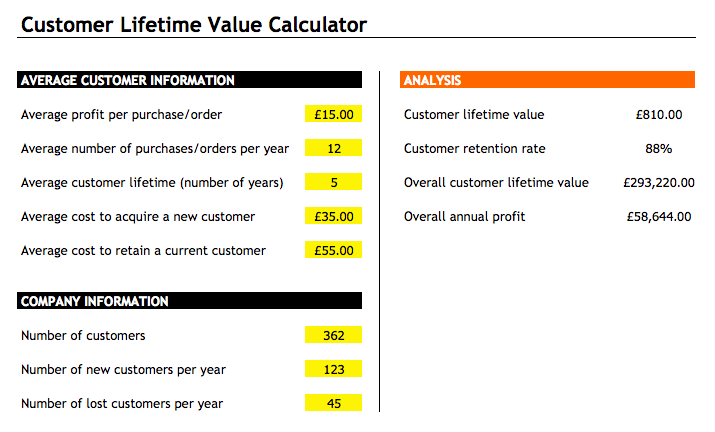

Here is a screen grab of my customer lifetime value, which is available for download here, completely free of charge.

How do you calculate your customer’s lifetime value, and were you surprised by the number?